Table provided to you either on your proxy card, in your e-mailed Proxy Materials, or on your Notice of ContentsAvailability of Proxy Materials. You are encouraged to access and review all of the information contained in the Proxy Materials before voting.

PROPOSAL 1Proposal Guide

| PROPOSAL | PAGE | BOARD VOTE

RECOMMENDATION |

| PROPOSAL 1 – ELECTION OF DIRECTORS | | |

| Our Board of Directors believes that the eight director nominees named herein contribute the breadth of knowledge and experience needed for the advancement of our business strategies and objectives | 4 | For |

| PROPOSAL 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | |

| The Audit Committee of our Board of Directors has appointed KPMG LLP as the independent registered public accounting firm for the year ending December 31, 2017 and requests stockholders to ratify, confirm, and approve the appointment | 4 | For |

| PROPOSAL 3 – ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | | |

| Our Board of Directors believes our compensation program is appropriately structured to reward our named executive officers for the continued performance of the company, encourage a disciplined approach to management, and maintain focus on the creation of long-term value for our stockholders | 5 | For |

| PROPOSAL 4 – ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES BY STOCKHOLDERS ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | | |

| Our Board of Directors believes an advisory vote to approve executive compensation every one year will lead to a more meaningful and coherent communication between the company and our stockholders on the compensation of our named executive officers | 6 | For Every One Year |

| Realty Income|2017 Proxy Statement | 1 |

Proxy Summary

Director Nominees2016 Performance Highlights

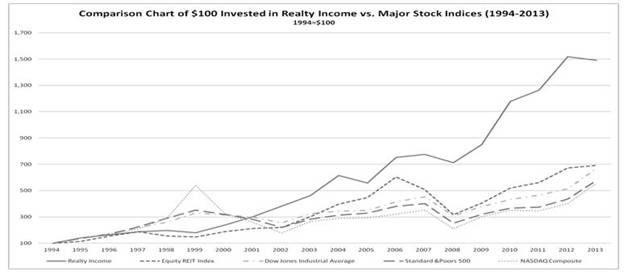

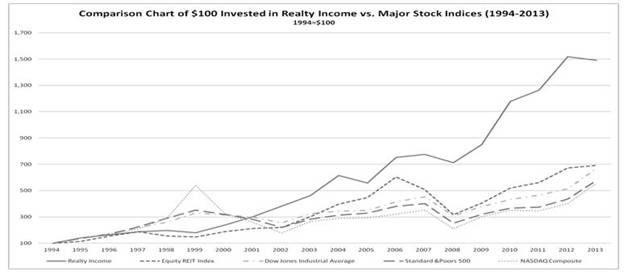

| | EARNINGS AND DIVIDEND GROWTH – We surpassed $1.0 billion in rental revenue in 2016 by completing a company-record-high volume of property acquisitions and actively managing our portfolio to maximize value. These activities contributed to healthy 2016 earnings growth, including net income of $1.13 per share and AFFO of $2.88 per share, supporting the payment of multiple dividend increases throughout 2016. Our focus on providing dependable monthly dividends that increase over time helps drive strong total shareholder return (TSR) performance year over year. | | |

| | | | |

|  | |

| | | | |

| (1) | For a calculation of Adjusted Funds from Operations (AFFO) per share, see page 47 of our Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC) on February 23, 2017, which also includes a Generally Accepted Accounting Principles (GAAP) reconciliation of this non-GAAP measure. | | |

| (2) | Realty Income TSR does not include reinvestment of dividends. Our TSR would be 15.8% assuming the compounded reinvestment of dividends on the ex-dividend date. Data sourced from FactSet as of December 31, 2016. | | |

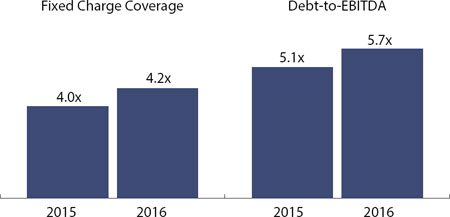

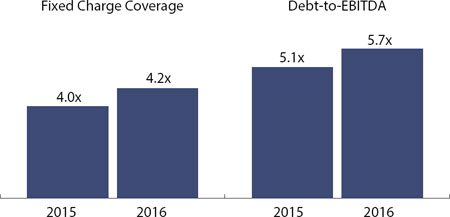

| BALANCE SHEET – As we grow our earnings and dividend, we remain committed to managing our balance sheet in a conservative manner. | |

| | |

|  | |

| | |

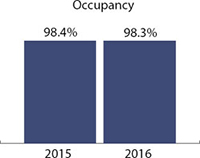

| PORTFOLIO OCCUPANCY – The quality of our real estate portfolio as well as the experience of our team led to another year of consistently high portfolio occupancy. | |

| | |

|  | |

| | |

| 2 | Realty Income|2017 Proxy Statement |

Proxy Summary

Corporate Governance Highlights

We remain committed to managing the company for the benefit of our stockholders and maintaining good corporate governance practices. In 2017, we further enhanced our corporate governance practices by instituting an 18-month minimum vesting provision on stock option and stock appreciation rights. In addition to this enhancement, we continue to uphold the following features of our corporate governance practices to maintain the company’s reputation for integrity and serving its stockholders responsibly:

| ü | All directors are subject to an annual election with a majority voting standard. |

| ü | Our Board of Directors is structured with a separate independent Chairman and Chief Executive Officer (CEO). |

| ü | All directors with the exception of our CEO are independent, and all members of our Audit, Compensation, Nominating/Corporate Governance, and Technology Risk committees are independent. |

| ü | Our directors conduct annual self-evaluations and participate in orientation and continuing education programs in accordance with our Corporate Governance Guidelines. |

| ü | Our Board of Directors conducts an annual Enterprise Risk Management process to identify and assess management’s visibility into company risk. |

| ü | Our directors, officers, and other employees are subject to a Code of Business Ethics to ensure our business is conducted in accordance with the highest standards of moral and ethical behavior. |

| ü | Our Board of Directors has adopted a “whistleblower” policy to provide a line of communication to directors for anonymously reporting concerns. |

| ü | Our directors, officers, other employees and their family members are subject to anti-hedging and anti-pledging policies to ensure they are not engaging in any transaction that might allow them to realize gains from declines in our securities. |

| ü | Our Board of Directors has voluntarily adopted a formal clawback policy in accordance with the Dodd-Frank Act. |

| ü | Our directors and named executive officers have minimum stock ownership requirements to closely align the interests of these individuals with the interests of our stockholders. |

| ü | The restricted stock and restricted stock unit awards for our named executive officers have double-trigger provisions, so that both a change in control and a qualifying termination need to occur in order for the vesting of outstanding shares to accelerate. |

Executive Compensation Highlights

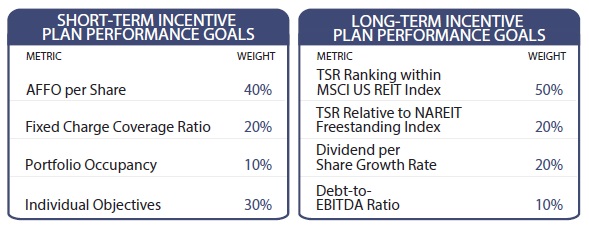

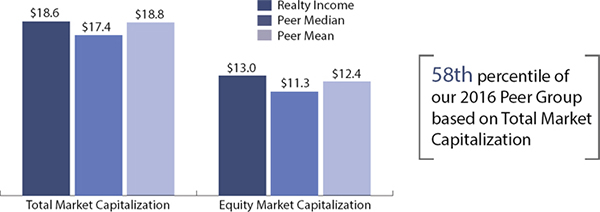

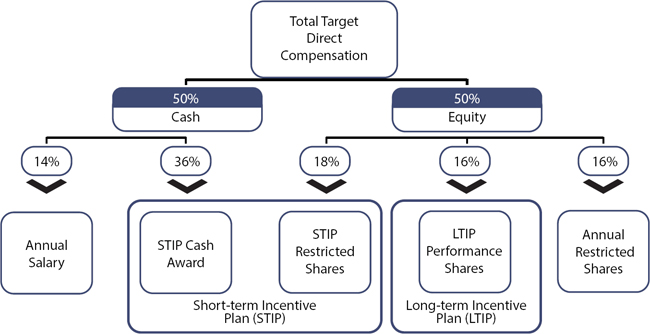

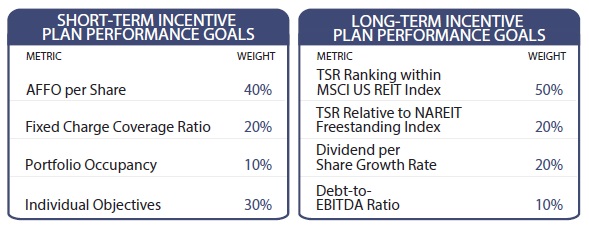

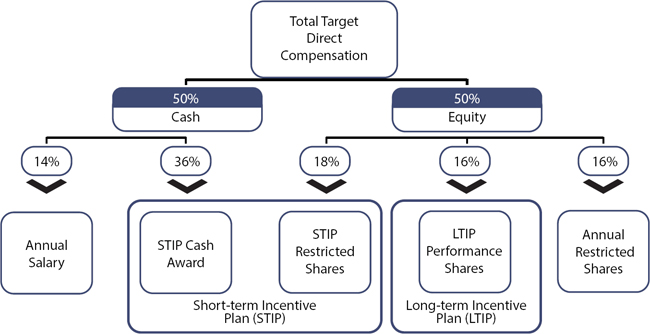

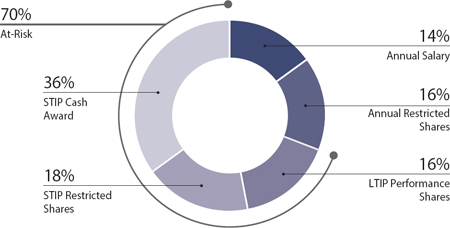

We believe our performance demonstrates the effectiveness, over time, of the execution of our strategic business plan, and the alignment of our compensation program with our philosophy to reward executives for enhancing long-term stockholder value. In structuring executive compensation, the Compensation Committee, in consultation with its independent compensation consultant, considers how each component of compensation motivates performance and allows us to attract and retain highly qualified named executive officers. Our compensation program focuses on pay for performance principles that are linked to short-term and long-term financial and operational metrics, including relative total stockholder return. The following are some key highlights of the 2016 plan:

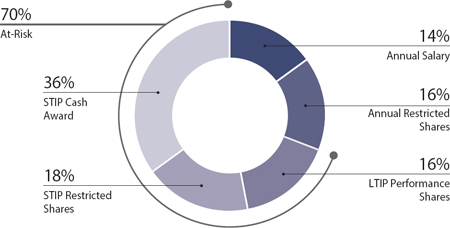

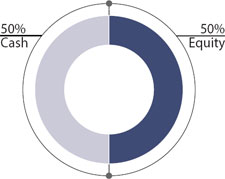

| ü | Our 2016 Short-Term Incentive Program (STIP) consisted of variable cash (two-thirds) and equity (one-third) compensation based primarily on the achievement of our short-term corporate operating and financial goals as well as individual performance. 70% of compensation awarded under this program was based on objective criteria and 30% was based on subjective evaluation of individual performance. |

| ü | Our 2016 Long-Term Incentive Program (LTIP) consisted of equity compensation based on the achievement of our long-term performance goals over a three-year performance period. 70% of compensation awarded under this program was based on our TSR performance relative to select industry indices and 30% was based on achieving objective operating metrics. |

| ü | Under both the STIP and LTIP programs, no compensation is awarded for below-threshold performance and maximum payouts for 2016 awards were capped at 150% of target. All of the compensation awarded under the programs is at-risk. |

| ü | Approximately 70% of our CEO’s total target direct compensation for the 2016 performance year consisted of compensation that was at-risk based on the achievement of certain performance metrics. |

We believe our compensation program effectively links the compensation awarded to our executives to the achievement of the company’s financial and strategic goals, thus creating alignment with the interests of our stockholders.

| Realty Income|2017 Proxy Statement | 3 |

Proposals

Proposal 1 - Election of Directors

Our Board of Directors currently consists of eight directors who contribute the breadth of knowledge and experience necessary for the advancement of our business strategies and objectives. Based uponon the recommendation of our Nominating/Corporate Governance Committee, our Board of Directors has nominated seventhe following current eight directors for re-election at the Annual Meeting to serve for a one-year term expiring at theour annual meeting of stockholders in 20152018, and until their respective successors have been duly elected and qualify:

1.Kathleen R. Allen, Ph.D.

2.John P. Case

3.A. Larry Chapman

4.Priya Cherian Huskins

5.Michael D. McKee

6.Gregory T. McLaughlin

7.Ronald L. Merriman

| Director Name | Age | Independent | | Audit | Compensation | Nominating/ Corporate Governance | Technology Risk |

| Kathleen R. Allen | 71 |  | |  | | | Chair |

| John P. Case | 53 | | | | | | |

| A. Larry Chapman | 70 |  | |  | | |  |

| Priya Cherian Huskins | 44 |  | | | Chair |  |  |

| Michael D. McKee | 71 |  | | |  | Chair | |

| Gregory T. McLaughlin | 57 |  | |  |  | | |

| Ronald L. Merriman | 72 |  | | Chair | |  | |

| Stephen E. Sterrett | 61 |  | | |  | |  |

For more information regarding our nominees, please see the “Board of Directors” below.Directors and Corporate Governance” section of this Proxy Statement beginning on page 7.

| OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERSVOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE. |

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

PROPOSALProposal 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee of our Board of Directors has appointed KPMG LLP as the independent registered public accounting firm to audit our consolidated financial statements and internal control over financial reporting for the year ending December 31, 2014.2017. Representatives of KPMG LLP are expected to be present at the Annual Meeting and will be provided an opportunity to make a statement if the representatives desire to do so. The representatives are also expected to be available to respond to appropriate questions.

Although ratification by our stockholders is not a prerequisite to the power of the Audit Committee to appoint KPMG LLP as our independent registered public accounting firm, our Board and the Audit Committee believes such ratification to be advisable and in the best interestsinterest of the company. Accordingly, stockholders are being requested to ratify, confirm, and approve the appointment of KPMG LLP as our independent registered public accounting firm to conduct the annual audit of our consolidated financial statements and internal control over financial reporting for fiscalthe year 2014.ending December 31, 2017. If the stockholders do not ratify the appointment of KPMG LLP, the appointment of an independent registered public accounting firm will be reconsidered by the Audit Committee; however, the Audit Committee has appointed KPMG LLP notwithstanding the failure of the stockholdersno obligation to ratifychange its appointment.appointment based on stockholder ratification. If the appointment of KPMG LLP is ratified, the Audit Committee will continue to conduct an ongoing review of KPMG LLP’s scope of engagement, pricing and work quality, among other factors, and will retain the right to replace KPMG LLP at any time.

| OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP. |

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2014.

| 4 | Realty Income|2017 Proxy Statement |

6

Table of ContentsProposals

PROPOSAL 3

ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERSProposal 3 - Advisory Vote to Approve the Compensation of Our Named Executive Officers

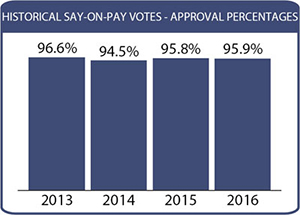

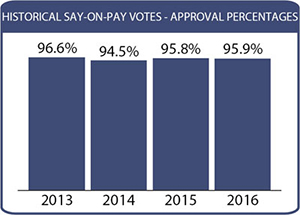

Our Board of Directors has determined to hold anadopted a policy of providing for annual “say on pay”“say-on-pay” advisory vote.votes. In accordance with our Board of Director’s determination and Section 14A of the Securities Exchange Act of 1934, as amended or the Exchange Act,(Exchange Act), and as a matter of good corporate governance, we are asking our stockholders to approvevote on a non-binding, advisory basis to approve the compensation paid to our named executive officers, as described in the “Executive Compensation” of this Proxy Statement, including the Compensation Discussion and Analysis and the executive compensation tables that follow.

In an effort to align the interests of management with those of our stockholders, our compensation program focuses on pay for performance principles that are linked to short-term and long-term financial and operational metrics, including relative total stockholder return. Our compensation mix rewards for the continued performance of the company, encourages a disciplined approach to management, and maintains focus on the creation of long-term value for our stockholders. We believe this structure is competitive and allows us to attract, motivate, and retain highly qualified executive officers.

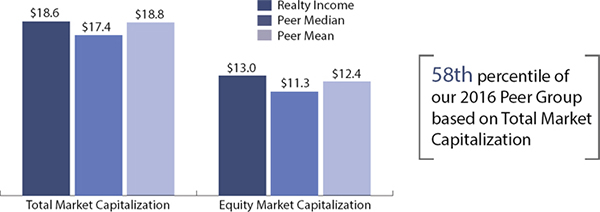

In connection with reviewing our compensation program and the 2016 compensation paid to our named executive officers, it is important to consider the company’s excellent performance results achieved in 2016, which include:

| ü | We invested $1.86 billion in high-quality real estate properties and funded the acquisitions by raising approximately $573 million in attractively-priced equity capital, and $600 million in unsecured, long-term fixed rate debt at a record-low yield for our company. |

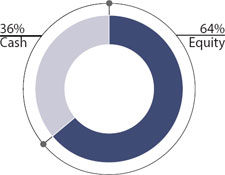

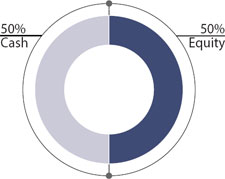

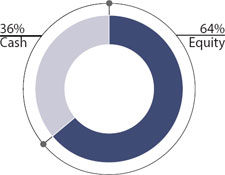

| ü | We remained committed to a conservative capital structure. At December 31, 2016, 70% of our balance sheet was represented by common equity. |

| ü | We maintained high portfolio occupancy while managing another active year for lease expiration activity, recapturing 105% of expiring rent on properties re-leased during the year. Our proactive approach to managing our portfolio continues to maximize the cash flow generated from our properties. |

These factors contributed to net income per share of $1.13, and AFFO per share growth of 5.1% to $2.88 in 2016, which allowed us to increase our dividend paid per share in 2016 by 5.3% over 2015, which helped drive a 16.0% TSR (refer to page 47 of our Annual Report on Form 10-K filed with the SEC on February 23, 2017 for a GAAP reconciliation of net income available to common stockholders to AFFO per share, a non-GAAP measure).

Based on the company’s performance in 2016, our named executive officers were awarded compensation in accordance with our STIP and LTIP, in addition to a fixed compensation component. All of the compensation awarded under the 2016 STIP and LTIP is based on the following performance goals and is at-risk, and not guaranteed:

The performance hurdles and weightings for each program are determined by the Compensation Committee, in consultation with its independent compensation consultant. This structure effectively links the compensation awarded to our executives to the achievement of the company’s financial and strategic goals. The independent members of our Board of Directors believe that the performance-based structure of our compensation program, as summarized above and detailed in the “Executive Compensation” section on page 23, allows the company to attract and retain talented executives while appropriately aligning their interests with the interests of our stockholders to support long-term value creation. Unless our Board of Directors modifies its determination on the frequency of future “say-on-pay” advisory votes, the next vote will be held at the annual meeting of stockholders in 2018.

| OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS. |

| Realty Income|2017 Proxy Statement | 5 |

Proposals

Proposal 4 - Advisory Vote on the Frequency of Future Advisory Votes by Stockholders on the Compensation of Our Named Executive Officers

In accordance with the Dodd-Frank Act of 2010, we are seeking a non-binding, advisory vote as to the frequency with which stockholders would have an opportunity to provide an advisory vote to approve the executive compensation of our named executive officers (which consistofficers. Stockholders have the option of selecting a frequency of one, two, or three years, or abstaining.

While we will continue to monitor developments in this area, our Chief Executive Officer, former Chief Executive Officer, Chief Financial OfficerBoard of Directors believes that an advisory vote to approve executive compensation every one year is appropriate. This will enable our stockholders to vote, on an advisory basis, to approve the most recent executive compensation information that is presented in our proxy statement, relative to that year’s company performance, leading to a more meaningful and coherent communication between us and our next three highest paid executives), as such compensation is described inshareholders on the Compensation Discussion and Analysis section beginning on page 22, the tabular disclosure regarding such compensation beginning on page 40 and the accompanying narrative disclosure set forth in this proxy statement.

We believe that our compensation policies and procedures are competitive, are focused on pay-for-performance principles and are strongly aligned with the long-term interests of our stockholders. The following is a summary of the key highlights of our executive compensation program:

•Almost all of our named executive officers’ 2013 pay was tied to performance. In 2013, approximately 67% of our CEO’s total direct compensation and approximately 79%-88% of our other named executive officers’ total direct compensation consisted of compensation that is “at risk” based on our performance. Included in the CEO’s 2013 compensation is a time-based promotion equity grant. Excluding this one-time grant, approximately 93% of our CEO’s total direct compensation was considered “at risk.” In determining compensation we focus on both short and long-term performance based on company financial and operational metrics as well as stockholder returns. Typically 100% of the annual equity awards we grant to our executive officers are based on our performance.officers.

•Our named executive officers delivered extraordinary, and in some cases record-setting, performance in 2013. The most notable results that influenced 2013 compensation included:

Substantial increase in dividend per share. Our executives delivered operating results that enabledBased on the factors discussed, our Board of Directors recommends that future advisory votes to increaseapprove executive compensation occur every one year until the dividends paid per common sharenext advisory vote on the frequency of advisory votes to approve executive compensation. Shareholders are not being asked to approve or disapprove our Board’s recommendation, but rather to indicate their choice among the following frequency options: one year, two years, or three years, or to abstain from voting.

This vote is advisory, and therefore not binding on us, the Compensation Committee or our Board of Directors. However, we value the opinions of our stockholders in 2013 by 21.2% over dividends paid per share in 2012, which isand will take into account the largest increase in our company’s history and is over 16x greater than the averageoutcome of the per share dividend increase duringvote when considering the last three years.frequency of submitting to stockholders a resolution to afford stockholders the opportunity to vote on executive compensation.

| OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR EVERY ONE YEAR” APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS. |

Significant increase in funds from operations (FFO) per share. Our executives delivered a 19.4% increase in FFO per share for 2013 compared to 2012 and a 19.3% increase in Normalized FFO per share for 2013 compared to 2012. These represent the largest increases in our company’s history. We define normalized FFO as FFO excluding the merger related costs for our January 2013 acquisition of American Realty Capital Trust, Inc., or ARCT.

| 6 | Realty Income|2017 Proxy Statement |

Record acquisitions. Our executives delivered a record year for new property acquisitions as we invested $4.7 billion in real estate, including $3.2 billion of real estate acquired in January in connection with the acquisition of ARCT and an additional $1.5 billion invested in 459 new properties and properties under development at an initial lease yield of 7.1%.

Capital rating upgrade. Standard & Poor’s Ratings Services upgraded our senior unsecured debt ratings to BBB+ from BBB and our preferred stock ratings to BBB- from BB+, with a stable outlook.

•We paid certain executives special compensation related to two events outside the ordinary course of business that had an impact on 2013 compensation for our named executive officers. The non-recurring payments were:

• Restricted stock awards granted in connection with our acquisition of American Realty Capital Trust, Inc.

• Restricted stock awards granted in connection with the appointment of our new CEO.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL, ON A NON-BINDING ADVISORY BASIS THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DESCRIBED IN THE COMPENSATION DISCUSSION AND ANALYSIS SECTION AND THE RELATED TABULAR AND NARRATIVE DISCLOSURE SET FORTH IN THIS PROXY STATEMENT.

7

TableBoard of ContentsDirectors and Corporate Governance

BOARD OF DIRECTORSDirector Nominees

The following table sets forth certain information asBoard of March 6, 2014 concerningDirectors has nominated our current directors. Each person listedeight directors, identified below, except for Mr. Lewis, is a director nominee for re-election at the Annual Meeting. Mr. Case was appointed by the Board of DirectorsMeeting to serve asfor a memberone-year term expiring at our annual meeting of the Board upon his promotion to Chief Executive Officerstockholders in September 2013. Upon his retirement as Chief Executive Officer in September 2013, Mr. Lewis maintained his position as Vice Chairman of the Board of Directors. The Nominating/Corporate Governance Committee, in consultation with Mr. Lewis, did not nominate Mr. Lewis for re-election to the Board at the Annual Meeting,2018, and intends to reduce the number of authorized directors under our Bylaws to seven.

Name

| Title

| Age

|

Kathleen R. Allen, Ph.D.

| Director

| 68

|

John P. Case

| Chief Executive Officer and Director

| 50

|

A. Larry Chapman

| Director

| 67

|

Priya Cherian Huskins

| Director

| 41

|

Thomas A. Lewis

| Vice Chairman

| 61

|

Michael D. McKee

| Chairman

| 68

|

Gregory T. McLaughlin

| Director

| 54

|

Ronald L. Merriman

| Director

| 69

|

Board of Director Biographies

until their respective successors are duly elected and qualify. The information presented below highlights each director nominee’s specific experience, qualifications, attributes, and skills that led our Board of Directors to the conclusion that he/she should serve as a director. We believe that all of our director nominees have a reputation for integrity, honesty, and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Realty Income and our Board of Directors. Finally, weWe also value their significantthe additional perspective that comes from the experience of serving on other companycompanies’ boards of directors and board committees.

Kathleen R. Allen, Ph.D.

Kathleen R. Allen, Ph.D. has been our director since February 2000. She is a professor at the Marshall School of Business and the director of the Center for Technology Commercialization at the University of Southern California (1991-present). She was the co-founder and Chairwoman of Gentech Corporation (1994-2004) and in 2006 co-founded and became the Chief Executive Officer and served on the board of directors of N2TEC Institute, a nonprofit company focused on technology commercialization in rural America, until it completed its mission in 2013. Dr. Allen has co-founded four private companies, is currently a principal and on the board of directors of a real estate investment and development company, and serves on the board of advisors for two life science companies as well as the Children’s Hospital/Saban Institute’s Center for Innovation in Pediatrics.

Kathleen R. Allen, Ph.D.

Age:71 Director Since:2000 Committees:Audit and

Technology Risk (Chair) Independent:Yes | Experience Kathleen R. Allen, Ph.D. is Professor Emeritus at the Marshall School of Business and the founding director of the Center for Technology Commercialization at the University of Southern California (1991-present). She was the co-founder and chairwoman of Gentech Corporation (1994-2004) and in 2006 co-founded and became the Chief Executive Officer and served on the board of directors of N2TEC Institute, a nonprofit company focused on technology commercialization in rural America, until it completed its mission in 2013. Dr. Allen has co-founded four private companies, is currently a principal and on the board of directors of a real estate investment and development company, and serves on the board of advisors for two life science companies. She is a Visiting Scholar at the Department of Homeland Security where she advises on issues related to technology deployment, including cybersecurity. She is the author of 15 books in the field of entrepreneurship and technology commercialization, a field in which she is considered an expert. Qualifications As a distinguished businesswoman, entrepreneur, and consultant, Dr. Allen has helped our Board of Directors identify and assess the risks associated with new endeavors. She has also worked with many early-growth and established companies to develop effective leadership and team-building skills. With her years of experience in risk management in the areas of business models, investment opportunities, and technology, commercialization, a field in which she is considered an expert. Dr. Allen is chairwoman of our Strategic Planning Committee and is a member of our Audit Committee and our Compensation Committee. As a distinguished businesswoman, entrepreneur, and consultant, Dr. Allen has helped our Board of Directors identify and assess the risks associated with new endeavors. She has also worked with many early-growth and established companies to develop effective leadership and team-building skills, which she has implemented during her participation on various board committees. With her years of experience in risk management in the areas of business models, investment opportunities, and markets, Dr. Allen brings to the Board of Directors achievement in strategic business planning, which is a key part of our growth strategy.

|

| Realty Income|2017 Proxy Statement | 7 |

Board of Directors and Corporate Governance

John P. Case

Chief Executive Officer

and Director Age:53 Director Since:2013Committees:None Independent:No | Experience Mr. Case has been the Chief Executive Officer since September 2013. He joined Realty Income in 2010 as Executive Vice President, Chief Investment Officer and served in this capacity until March 2013, when he was promoted to President, Chief Investment Officer. Prior to joining Realty Income, Mr. Case served for 19 years as a New York-based real estate investment banker. He began his investment banking career at Merrill Lynch, where he worked for 14 years, and was named a Managing Director in 2000. Following his tenure at Merrill Lynch, Mr. Case was co-head of Americas Real Estate Investment Banking at UBS and later the co-head of Real Estate Investment Banking for RBC Capital Markets, where he also served on the firm’s Global Investment Banking Management Committee. During Mr. Case’s investment banking career, he was responsible for more than $100 billion in real estate capital markets and advisory transactions. Mr. Case currently serves as a member of the Board of Trustees of Washington and Lee University. In addition, Mr. Case is extensively involved in the broader real estate industry, serving on the Executive Board of the National Association of Real Estate Investment Trusts (NAREIT), The President’s Council of the Real Estate Roundtable, and as a member of the International Council of Shopping Centers (ICSC). Previously, he served on the Executive Committee of the Board of Directors for the National Multi-Housing Council (NMHC) and as a member of the Urban Land Institute. Qualifications Mr. Case has demonstrated extensive knowledge of the financial and operating issues facing real estate organizations. His vast experience and understanding of real estate, REITs, and financial strategy has helped guide the company and successfully execute its business plan. In addition, Mr. Case’s knowledge of all aspects of the company’s business positions him as a valuable member of, and contributor to, our Board of Directors. |

| |

A. Larry Chapman

Age:70 Director Since:2012 Committees:Audit and

Technology Risk Independent:Yes | Experience A. Larry Chapman is a retired 37-year veteran of Wells Fargo, having served most recently as Executive Vice President and the Head of Commercial Real Estate from 2006 until his retirement in June 2011, and as a member of the Wells Fargo Management Committee. Mr. Chapman joined Wells Fargo in 1974 in its Houston Real Estate office. In 1987, he was promoted to President of Wells Fargo Realty Advisors, a wholly-owned subsidiary of Wells Fargo & Co. The subsidiary’s primary responsibility was managing Wells Fargo Mortgage and Equity Trust, which was formed in 1970 and sold in 1989. He remained President of Wells Fargo Realty Advisors until 1990, and was promoted to Group Head of the Wells Fargo Real Estate Group in 1993. Mr. Chapman managed the Wells Fargo Real Estate Group until his 2006 promotion to Executive Vice President and Head of Commercial Real Estate for Wells Fargo on a nationwide basis. Mr. Chapman is a former board member of the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley, past governor and trustee of the Urban Land Institute, former member of the National Association of Real Estate Investment Trusts (NAREIT), and member and past trustee of the International Council of Shopping Centers (ICSC). He currently serves on the board of directors of CBL & Associates Properties, Inc. (NYSE: CBL) (August 2013-present). Qualifications Mr. Chapman’s financial acumen and extensive commercial real estate experience across many industries and tenant types, provide valuable insight and expertise to the Board of Directors and our senior management team as we continue to expand our real estate portfolio. In addition, his background as a leader of a Fortune 500 company, and as a member of its management team, further enhances the quality of leadership and oversight provided by our Board of Directors. |

| 8 | Realty Income|2017 Proxy Statement |

Board of Directors and Corporate Governance

Priya Cherian Huskins

Age:44 Director Since:2007 Committees:Compensation

(Chair), Nominating/Corporate Governance, and Technology

Risk Independent:Yes | Experience Priya Cherian Huskins is Senior Vice President and partner at Woodruff-Sawyer & Co., a commercial insurance brokerage firm (2003-present). Prior to joining Woodruff-Sawyer & Co., Ms. Huskins served as a corporate and securities attorney at the law firm of Wilson Sonsini Goodrich & Rosati (1997-2003). She has served on the advisory board of the Stanford Rock Center for Corporate Governance since 2012, the board of directors of Woodruff-Sawyer & Co. since 2016, the board of directors of the Silicon Valley Directors’ Exchange (SVDX) since 2013, and served on the board of directors of the National Association of Corporate Directors, Silicon Valley Chapter (2006-2013). Qualifications With her background in law, insurance, and risk management, Ms. Huskins brings a focus on these areas to our Board of Directors. As a recognized expert in directors and officers liability risk and its mitigation, Ms. Huskins provides valuable insight into our risk management strategy. In addition, she brings experience regarding corporate governance matters, including compensation best practices, and ways that corporate governance can enhance stockholder value. Ms. Huskins’ experience makes her a valuable component of a well-rounded Board of Directors. |

| |

Michael D. McKee

Age:71 Director Since:1994 Non-Executive Chairman Since:2012 Committees:Compensation and Nominating/Corporate Governance (Chair) Independent:Yes | Experience Michael D. McKee is the Executive Chairman of HCP, Inc. (NYSE: HCP) (May 2016-present). Prior to that, he was the Chief Executive Officer of Bentall Kennedy (U.S.), a registered real estate investment advisor (February 2010-April 2016). He was the Vice Chairman (1999-2008) and Chief Executive Officer (2007-2008) of The Irvine Company, a privately-held real estate investment company, as well as its Chief Operating Officer (2001-2007), Chief Financial Officer (1997-2001) and Executive Vice President (1994-1999). Prior to joining The Irvine Company, Mr. McKee was a partner in the law firm of Latham & Watkins (1986-1994). Through each of these positions, Mr. McKee has obtained extensive real estate experience and provides valuable insight and expertise to the Board and our senior management team. He has served on the board of directors of HCP, Inc. (NYSE: HCP) (1987-present), Bentall Kennedy (U.S.) (2008-2012), First American Financial Corporation (NYSE: FAF) (2011-present), the Tiger Woods Foundation (2006-present), The Irvine Company (1998-2008) and Hoag Hospital Foundation (1999-2008). Qualifications Mr. McKee’s business and legal experience includes numerous acquisition and disposition transactions, as well as a variety of public and private offerings of equity and debt securities. Additionally, he has been exposed to various compliance issues as they relate to real estate investment trusts. With his knowledge of the complex issues facing real estate companies today and his understanding of what makes businesses work effectively and efficiently, Mr. McKee provides valuable insight to our Board of Directors. |

| Realty Income|2017 Proxy Statement | 9 |

Board of Directors and Corporate Governance

Gregory T. McLaughlin

Age:57 Director Since:2007 Committees:Audit and Compensation Independent:Yes | Experience Gregory T. McLaughlin is the President, PGA TOUR Champions and a Senior Vice President with the PGA TOUR in Ponte Vedra Beach, Florida (2014-present). Prior to joining the PGA TOUR, Mr. McLaughlin was President and Chief Executive Officer of the Tiger Woods Event Corporation and Tiger Woods Foundation in Irvine, California (1999-2014), Vice President of Business Development of the Western Golf Association/Evans Scholars Foundation (1993-1999), and Vice President of Business Development of the Los Angeles Junior Chamber of Commerce (1988-1993). He is currently a member of the PGA TOUR Executive Committee. Qualifications With his diverse background, Mr. McLaughlin offers a unique perspective to the Board of Directors on a variety of business and legal matters. His business and legal experience includes tax-exempt status and financing as well as business development, capital raising, and program development. Additionally, his leadership skills in managing a variety of different organizations brings financial reporting expertise, especially as it relates to audit and tax matters. His proven effectiveness working with complex issues makes him a valuable member of our Board of Directors. |

| |

| |

Ronald L. Merriman

Age:72 Director Since:2005 Committees:Audit (Chair) and Nominating/Corporate Governance Independent:Yes | Experience Ronald L. Merriman is a retired Vice Chairman and partner of KPMG LLP, a global accounting and consulting firm (1967-1997). At KPMG LLP, Mr. Merriman served as Vice Chairman of the Executive Management Committee. More recently, Mr. Merriman was the managing director of Merriman Partners, a management advisory firm (2003-2011). Prior to founding Merriman Partners, Mr. Merriman served as a managing director of O’Melveny & Myers law firm (2000-2003), Executive Vice President of Carlson Wagonlit Travel (1999-2000), and President of Ambassador Performance Group, Inc. (1997-1999). Mr. Merriman serves on the board of directors and is the chairman of the audit committee of the following public companies: Aircastle Limited (NYSE: AYR) (2006-present), and Pentair, Plc, formerly Pentair, Ltd. (NYSE: PNR) (2005-present). Additionally, he serves on the compensation committee of Aircastle Limited (2012-Present) and on the audit committee of Haemonetics Corporation (NYSE: HAE) (2005-Present). Qualifications Mr. Merriman is an experienced financial leader with the skills necessary to lead our Audit Committee. Throughout his career, he has been exposed to various issues involving accounting and auditing standards, business law and corporate ethics. His professional background and experience on other audit committees make him a valuable asset, both on our Board of Directors and as the Chair of our Audit Committee. Mr. Merriman’s positions have provided him with a wealth of knowledge in addressing financial and accounting matters. The depth and breadth of his exposure to complex financial issues makes him a skilled advisor to the Board of Directors. |

| 10 | Realty Income|2017 Proxy Statement |

Board of Directors and Corporate Governance

Stephen E. Sterrett

Age:61 Director Since:2014 Committees:Compensation and Technology Risk Independent:Yes | Experience Stephen E. Sterrett retired as the Senior Executive Vice President and Chief Financial Officer of Indianapolis-based Simon Property Group, Inc., an S&P 100 company, in December 2014. Mr. Sterrett joined the Simon organization in 1988, was named Treasurer in 1993, and was the Chief Financial Officer from 2000 until his retirement. Prior to joining Simon Property Group, Inc., he was a Senior Manager with the international accounting firm of Price Waterhouse. Mr. Sterrett serves on the boards of Berry Plastics Group, Inc. (NYSE: BERY) and Equity Residential (NYSE: EQR). Mr. Sterrett is active in several professional organizations, including the National Association of Real Estate Investment Trusts (NAREIT), the International Council of Shopping Centers (ICSC) and is a past member of the Indiana CPA Society. Qualifications As the former Chief Financial Officer of Simon Property Group, Inc., Mr. Sterrett has direct experience with matters arising from the business and financial issues pertaining to the company, particularly in the areas of corporate finance and capital markets. His experience as a Chief Financial Officer in the REIT industry brings to our Board of Directors a comprehensive understanding of matters unique to REITs and enables him to make significant contributions to our Board of Directors. |

| |

Committees of the Board

Our Board of Directors has three standing committees that perform certain delegated functions of the Board: the Audit Committee, the Compensation Committee, and the Nominating/Corporate Governance Committee. The Board also has one special purpose committee, the Technology Risk Committee, which provides governance and oversight of the possible risks associated with the company’s technology and information systems. Each committee is composed entirely of independent directors within the meaning of our director independence standards, which reflect the NYSE director independence standards and the audit committee requirements of the SEC.

Each committee operates under a written charter, all of which were reviewed by their respective committees during 2016. Our Compensation and Nominating/Corporate Governance Committees updated their charters in 2016, and the Audit Committee updated its charter in February 2017 to provide additional enhancements. The Technology Risk Committee established its charter in connection with its formation in May 2015. In February 2017, the Board of Directors achievement in strategic business planning, which is a key partextended the duration of the Technology Risk Committee such that this committee will be deemed terminated, if not re-appointed, by the Board of Directors on or before June 1, 2018. Our Board of Directors may, from time to time, establish certain other committees to facilitate oversight over the management of the company. The charters of each of our growth strategy.standing committees are available on our company’s website at www.realtyincome.com.

| Realty Income|2017 Proxy Statement | 11 |

John P. Case

Mr. Case was promoted to Chief Executive Officer in September 2013. He joined Realty Income in 2010 as Executive Vice President, Chief Investment OfficerBoard of Directors and served in this capacity until March 2013, when he was promoted to President, Chief Investment Officer. Prior to joining Realty Income, Mr. Case served for 19 years as a New York-based real estate investment banker. Most recently he served as the co-head of Real Estate Investment Banking for RBC Capital Markets, where he also served on the firm’s Global Investment Banking Management Committee. Prior to joining RBC, he was co-head of America’sCorporate Governance

8AUDIT

Table of ContentsCOMMITTEE

| | | | |

| | Responsibilities |

Members: Ronald L. Merriman (Chair)

Kathleen R. Allen, Ph.D.

A. Larry Chapman

Gregory T. McLaughlin Independent:All

Meetings in 2016:8 | | ■ | Oversee compliance with legal and regulatory requirements; |

| ■ | Oversee the integrity of our financial statements; |

| ■ | Appoint, retain, and oversee our independent registered public accounting firm, approve any special assignments given to the independent registered public accounting firm, and review: |

| | ● | The scope and results of the audit engagement with the independent registered public accounting firm, including the independent registered public accounting firm’s letters to the Audit Committee; |

| | ● | The independence and qualifications of the independent registered public accounting firm; |

| | ● | The compensation of the independent registered public accounting firm; |

| | | ● | The performance of our internal audit function; and |

| | | ● | Any proposed significant accounting changes. |

Real Estate Investment Banking at UBS. He began his careerOur Board of Directors has determined that Messrs. Merriman, Chapman and McLaughlin qualify as audit committee financial experts, as defined in real estate investment banking at Merrill Lynch, where he workedItem 407(d) of Regulation S-K, and that all members of the Audit Committee are financially literate under the current listing standards of the NYSE and meet the Securities and Exchange Commission (the SEC) independence requirements for 13 years, and was named a managing director in 2000. Duringaudit committee membership. Our Board of Directors has considered Mr. Case’s career, he was responsible for more than $100 billion in real estate capital markets and advisory transactions. In addition, Mr. Case has been extensively involved in the broader real estate industry. He currently servesMerriman’s concurrent service on the National Associationaudit committees of Real Estate Investment Trusts (NAREIT)three other public companies and has determined that such simultaneous service does not impair his ability to effectively serve as Chair of our Audit Committee.

COMPENSATION

COMMITTEE

| | | |

| | Responsibilities |

Members: Priya Cherian Huskins (Chair)

Michael D. McKee

Gregory T. McLaughlin

Stephen E. Sterrett Independent:All

Meetings in 2016:8 | | ■ | Establish remuneration levels for our executive officers; |

| ■ | Review significant employee benefits programs; |

| ■ | Establish and administer executive compensation programs; |

| ■ | Conduct an annual review of our compensation philosophy; |

| ■ | Conduct an annual review of and approve the goals and objectives relating to the compensation of the CEO, including a performance evaluation to help determine and approve his compensation; |

| ■ | Review and approve all executive officers’ employment agreements and severance arrangements; |

| ■ | Manage and annually review executive officer short-term and long-term incentive compensation; and |

| ■ | Set performance metrics under all short-term and long-term incentive compensation plans as appropriate. |

Our Board of Governors and is a member of The President’s CouncilDirectors has determined that all of the Real Estate Roundtablemembers of the Compensation Committee are “independent” within the meaning of our director independence standards, the NYSE director independence standards (including those applicable to Compensation Committee members), are “non-employee directors” within the meaning of Rule 16b-3 of the Exchange Act, and are “outside directors” under the International Councilregulations promulgated under Section 162(m) of Shopping Centers (ICSC). He wasthe Internal Revenue Code of 1986, as amended. The Compensation Committee may delegate any or all of its responsibilities to a subcommittee of the Committee to the extent permitted by applicable law.

| 12 | Realty Income|2017 Proxy Statement |

Board of Directors and Corporate Governance

NOMINATING/

CORPORATE

GOVERANCE

COMMITTEE

| | | |

| | Responsibilities |

Members: Michael D. McKee (Chair) Priya Cherian Huskins

Ronald L. Merriman Independent:All

Meetings in 2016: 2 | | ■ | Provide counsel to our Board of Directors on the broad range of issues concerning the composition and operation of the Board of Directors; |

| ■ | Develop and review the qualifications and competencies required for membership on our Board of Directors; |

| ■ | Review and interview qualified candidates to serve on our Board of Directors; |

| ■ | Oversee the structure, membership, and rotation of the committees of our Board of Directors; |

| ■ | Review the Board of Directors compensation; |

| ■ | Assess the effectiveness of the Board of Directors and executive management; |

| ■ | Oversee succession planning for our executive management; and |

| ■ | Review and consider developments in corporate governance to ensure best practices are being followed. |

As part of these responsibilities, the Nominating/Corporate Governance Committee annually solicits input from each member of the Board of Directors to review the effectiveness of the National Multi-Housing Council (NMHC) from 2001 to 2009, serving on the Executive Committee from 2002 to 2004, the Real Estate Roundtable from 2009 to 2010,its operation and the Urban Land Institute from 2003 to 2010.

As the Chief Executive Officer, Mr. Case’s primary responsibility is to perform as a fiduciary for our stockholders in fulfilling our mission to provide monthly dividends that increase over time. This responsibility involves overseeing all committees thereof. The review consists of our operations, as well as creating and executing on the company’s strategy. The implementationan assessment of our strategy involves constant monitoring of the economic environment, analyzing factors that can impact our operations, and doing what is required to generate investor returns, while mitigating the risks that are taken to achieve those returns.

Mr. Case has demonstrated extensive knowledge of the financialits governance and operating issues facing real estate organizations. His vast understanding of real estate investment trusts and financial strategy has helped guidepractices which includes the company in recent years. In addition, Mr. Case’s knowledge of all aspects of the company’s business positions him as a valuable member of, and contributor to, our Board of Directors. Mr. Case is a member of our Strategic Planning Committee.

A. Larry Chapman

A. Larry Chapman has been our director since February 2012. He is a retired 37-year veteran of Wells Fargo, having served most recently as Executive Vice President and the Head of Commercial Real Estate from 2006 until his retirement in June 2011, and as a member of the Wells Fargo Management Committee. Mr. Chapman joined Wells Fargo in 1974 in its Houston Real Estate office. In 1987, he was promoted to President of Wells Fargo Realty Advisors, a wholly-owned subsidiary of Wells Fargo & Co. The subsidiary’s primary responsibility was managing Wells Fargo Mortgage and Equity Trust, which was formed in 1970 and sold in 1989. He remained President of Wells Fargo Realty Advisors until 1990, and was promoted to Group Head of the Wells Fargo Real Estate Group in 1993. Mr. Chapman managed the Wells Fargo Real Estate Group until his 2006 promotion to Executive Vice President and Head of Commercial Real Estate for Wells Fargo on a nationwide basis. Mr. Chapman is a former board member of the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley; past governor and trustee of the Urban Land Institute; former member of the National Association of Real Estate Investment Trusts; and member and past trustee of the International Council of Shopping Centers. Mr. Chapman is a member of our Audit and Compensation Committees. He currently serves on the board of directors of CBL & Associates Properties, Inc. (NYSE: CBL) (August 2013-present).

Mr. Chapman’s extensive commercial real estate experience, across many industries and tenant types, provides valuable insight and expertise to the Board and our senior management team as we continue to expand our real estate portfolio. In addition, his background as a leader of a Fortune 500 company, and as a member of its management team, further enhances the quality of leadership and oversight provided by our Board of Directors.

Priya Cherian Huskins

Priya Cherian Huskins has been our director since December 2007. She is Senior Vice President and partner at Woodruff-Sawyer & Co., a commercial insurance brokerage firm (2003-present). Prior to joining Woodruff-Sawyer & Co., Ms. Huskins served as a corporate and securities attorney at the law firm of Wilson Sonsini Goodrich & Rosati (1997-2003). She has served on the advisory board of the Stanford Rock Center for Corporate Governance since 2012,Guidelines that govern the boardoperation of directors of the Silicon Valley Directors’ Exchange (SVDX) since 2013, and served on the board of directors of the National Association of Corporate Directors, Silicon Valley Chapter (2006-2013). Ms. Huskins is Chairwoman of our Nominating/Corporate Governance Committee and is a member of our Strategic Planning Committee.

9

Table of Contents

With her background in law, insurance and risk management, Ms. Huskins brings a focus on these areas to our Board of Directors. As a recognized expert in directors and officers liability risk and its mitigation, Ms. Huskins provides valuable insight into our risk management strategy. In addition, she brings experience regarding corporate governance matters, including ways that corporate governance can enhance stockholder value. Ms. Huskins’s experience makes her a valuable component of a well-rounded Board of Directors and a key member of both committees on which she serves.

Michael D. McKee

Michael D. McKee has been a director since August 1994 and Chairman of the Board since February 2012. He is the Chief Executive Officer of Bentall Kennedy (U.S.), a registered real estate investment advisor (February 2010-present). He was the Vice Chairman (1999-2008) and Chief Executive Officer (2007-2008) of The Irvine Company, a privately-held real estate investment company, as well as Chief Operating Officer (2001-2007), Chief Financial Officer (1997-2001) and Executive Vice President (1994-1999) of The Irvine Company. Prior to joining The Irvine Company, Mr. McKee was a partner in the law firm of Latham & Watkins (1986-1994). Through each of these positions Mr. McKee has obtained extensive real estate experience and provides valuable insight and expertise to the Board and our senior management team. He has served on the board of directors of HCP, Inc. (NYSE: HCP) (1987-present) where he serves as Non-Executive Chairman, Bentall Kennedy (U.S.) (2008-2012), First American Financial Corporation (NYSE: FAF) (2011-present), the Tiger Woods Foundation (2006-present), The Irvine Company (1998-2008) and Hoag Hospital Foundation (1999-2008). In addition to being the chairman of our Board of Directors, Mr. McKee is a member of our Compensation Committee and our Nominating/Corporate Governance Committee.

Mr. McKee’s business and legal experience includes numerous acquisition and disposition transactions, as well as a variety of public and private offerings of equity and debt securities. Additionally, he has been exposed to various compliance issues as they relate to real estate investment trusts. With his knowledge of the complex issues facing real estate companies today and his understanding of what makes businesses work effectively and efficiently, Mr. McKee provides valuable insight to our Board of Directors.

Gregory T. McLaughlin

Gregory T. McLaughlin has been our director since June 2007. Mr. McLaughlin is currently a Senior Vice President with the PGA TOUR in Ponte Vedra, Florida (2014-present). Prior to joining the PGA TOUR, Mr. McLaughlin was President and Chief Executive Officer of the Tiger Woods Event Corporation and Tiger Woods Foundation in Irvine, California (1999-2014); Vice President of Business Development of the Western Golf Association / Evans Scholars Foundation (1993-1999); and Vice President of Business Development of the Los Angeles Junior Chamber of Commerce (1988-1993). He is currently a member of the Board of Directors of Repucom (2014-present). Mr. McLaughlin is Chairman of the Compensation Committee and is a member of the Audit Committee and the Strategic Planning Committee.

With his diverse background, Mr. McLaughlin offers a unique perspective to the Board of Directors on a variety of business and legal matters. His business and legal experience includes tax-exempt status and financing as well as business development, capital raising and program development. Additionally, his leadership skills in managing not-for-profit organizations brings financial reporting expertise, especially as it relates to audit and tax matters. His proven effectiveness working with complex issues makes him a valuable member of our Board of Director committees.

Ronald L. Merriman

Ronald L. Merriman has been our director since July 2005. He is a retired Vice Chairman and partner of KPMG LLP, a global accounting and consulting firm (1967-1997). At KPMG LLP, Mr. Merriman served as Vice Chairman of the Executive Management Committee. More recently, Mr. Merriman was the managing director of Merriman Partners, a management advisory firm (2003-2011). Prior to founding Merriman Partners, Mr. Merriman served as a managing director of O’Melveny & Myers law firm (2000-2003), Executive Vice President of Carlson Wagonlit Travel (1999-2000) and President of Ambassador Performance Group, Inc. (1997-1999). Mr. Merriman has served on the board of directors and is the chairman of the audit committee of the following public companies: Aircastle Limited (NYSE: AYR)(2006-

10

Table of Contents

present), Pentair, Ltd., formerly Pentair, Inc. (NYSE: PNR)(2005-present) and Haemonetics Corporation (NYSE: HAE)(2005-present). Additionally, he serves on the compensation committee for both Aircastle Limited (2012-Present) and Haemonetics Corporation (2011-Present). Mr. Merriman is Chairman of our Audit Committee and is a member of our Nominating/Corporate Governance Committee and our Strategic Planning Committee.

Mr. Merriman is an experienced financial leader with the skills necessary to lead our Audit Committee. Throughout his career, he has been exposed to various issues involving accounting and auditing standards, business law and corporate ethics. His professional background and experience on other audit committees make him a valuable asset, both on our Board of Directors and as the Chairman of our Audit Committee. Mr. Merriman’s positions have provided him with a wealth of knowledge in addressing financial and accounting matters. The depth and breadth of his exposure to complex financial issues makes him a skilled advisor to the Board of Directors.

TECHNOLOGY RISK

COMMITTEE

| | | |

| | Responsibilities |

Members: Kathleen R. Allen, Ph.D.

(Chair)

A. Larry Chapman

Priya Cherian Huskins

Stephen E. Sterrett Independent:All

Meetings in 2016: 2 | | ■ | Review and assess risks, including cyber security, associated with the company’s technology and information systems; |

| ■ | Receive reports from management or other third party organizations on key metrics for the company’s technology and information systems; and |

| ■ | Provide guidance on matters specifically related to the company’s technology and information systems. |

| | |

| | |

| | |

It is intended for the Technology Risk Committee to be of limited duration, and to help engage in assessing any potential technology risks at the company. The Technology Risk Committee will be deemed terminated, if not re-appointed, by the Board of Directors on or before June 1, 2018.

| Realty Income|2017 Proxy Statement | 13 |

Board of Directors and Corporate Governance

Corporate Governance

We believe that nothing is more important than a company’s reputation for integrity and serving as a responsible fiduciary for its stockholders.stockholders responsibly is of critical importance. We are committed to managing the company for the benefit of our stockholders and are focused on maintaining good corporate governance. Practices that illustrate this commitment include:

·Corporate Governance Guidelines

Our company has adopted Corporate Governance Guidelines that promote the functioning of the Board of Directors is currently comprised of eight directors, six of which are independent, non-employee directors;

·Ourand its committees and sets forth expectations as to how the Board of Directors is elected on an annual basis;

·We employ a majority vote standard for director elections;

·Our Compensation Committee works with independent consultants, in conducting annual compensation reviews for our key executives, and compensates each individual based on reaching certain performance metrics that determineshould operate. The guidelines include information about the successcomposition of the company;

·We adhere to all other corporate governance principles outlined in our “Corporate Governance Guidelines” document;

·We have established an anti-hedgingBoard of Directors, orientation and anti-pledging policy;continuing education, director compensation, Board of Director meetings, Board of Director committees, management succession, evaluation and

·We have a stock ownership program for our compensation of named executive officers, expectations of directors, and executive officers.

·We have adopted a clawback policy that enables us to recover incentive compensation awards ininformation regarding the eventannual performance evaluation of negligence or misconduct directly related to a material restatementthe Board of Directors. A current copy is available on our financial or operating results, or miscalculated performance metrics that, if calculated correctly, would have resulted in a lower payment.company’s website at www.realtyincome.com.

The Charters of each of our standing committees, our Code of Business Ethics and our Corporate Governance Guidelines are posted on our website at www.realtyincome.com and will be provided without charge upon request to the Corporate Secretary, Realty Income Corporation, 600 La Terraza Boulevard, Escondido, CA 92025-3873. During 2013, in accordance with the terms of each of our Committee Charters, each of our respective committees reviewed its charter. Our Audit Committee, Nominating/Corporate Governance Committee, and Compensation Committee made minor updates to their charters in February 2014. The Strategic Planning Committee determined that no updates to its charter were needed in 2013.

Code of Business Ethics. We have adopted a Code of Business Ethics that applies to our employees, officers and directors. The Board of Directors adopted the Code of Business Ethics to codify and formalize certain of our long-standing policies and principles that help ensure our business is conducted in accordance with the highest standards of moral and ethical behavior. Our Code of Business Ethics covers all areas of professional conduct, including conflicts of interest, insider trading and confidentiality, as well as requiring strict adherence to all laws and regulations applicable to our business and industry. We conduct annual training of employees regarding ethical behavior and require all employees to acknowledge the terms of, and abide by, our Code of Business Ethics. We intend to disclose any future amendments to or waivers of certain provisions of our Code of Business Ethics applicable to our principal executive officer, principal financial officer, principal accounting officer, controller and individuals performing similar functions on our website at www.realtyincome.com within five business days following such waiver or as otherwise required by the SEC or the NYSE.

Table of Contents

Our Board of Directors has adopted a “whistleblower” policy, which outlines a procedure for all interested parties, including employees, to submit confidential complaints, concerns, unethical business practices, violations or suspected violations for any and all matters pertaining to accounting, internal control or auditing.

We have adopted a Code of Business Ethics that applies to our directors, officers, and other employees. The Board of Directors adopted the Code of Business Ethics to codify and formalize certain of our long-standing policies and principles that help ensure our business is conducted in accordance with the highest standards of moral and ethical behavior. We conduct annual training with our employees regarding ethical behavior and require all employees to acknowledge the terms of, and abide by, our Code of Business Ethics. A current copy, as updated in May 2015, is available on our company’s website at www.realtyincome.com. We intend to disclose any future amendments to or waivers of certain provisions of our Code of Business Ethics applicable to our officers and directors on our website, within five business days following such waiver or as otherwise required by the SEC or the NYSE.

Anti-Hedging and Anti-Pledging Policy.Policy We

To ensure proper alignment with our stockholders, we have established policies that prohibit our directors, officers, other employees, and their family members from engaging in any transaction that might allow them to realize gains from declines in our securities. Specifically, we prohibit our directors, officers, employees, and their family members from engaging in transactions using derivative securities, short selling our securities, trading in any puts, calls or covered calls, writing purchase or call options and short sales, or otherwise participating in hedging, “stop loss,” or other speculative transactions involving our securities by officers, directors, other employees and their family members. Short selling our securities, trading in any puts, calls, covered calls or other derivative products involving our securities, or the writing of purchase or call options, short sales and other similar transactions are also prohibited for our officers, directors, other employees and family members.

securities. In addition, margin purchases of our securities and pledging any of our securities as collateral to secure loans is also prohibited. This prohibition means that our directors, officers, other employees, and their family members cannot hold our securities in a “margin account” nor can they pledge any of our securities for any loans or indebtedness.

Adoption of Compensation Clawback Policy. Policy Although the SEC still has not issued regulations regarding clawback policies, as required by

In accordance with the Dodd-Frank Act, we have recentlyour Board of Directors has voluntarily adopted our owna formal clawback policy which applies to outstanding awards and will apply to future awards. Our clawback policy provides that wethe company may recoup allrecover certain cash and/or equity-based incentive compensation paid or granted to an executive officer as defined pursuant to Rule 3b-7 under the Securities Exchange Act of 1934, as amended, during the three-year period preceding thea “triggering event” that was in excess of what would have been paid or granted to such executive officer after giving effect, as applicable, to the accounting restatement that resulted from the triggering event or to what would have been the correct calculation of the performance metric(s) used in determining that a triggering event had occurred.event.” A “triggering event” includes: i)

| (i) | a decision by the audit committee to effect an accounting restatement of previously published financial statements caused by material non-compliance by the company with any financial reporting requirement under the federal securities laws due to fraud, misconduct, negligence, or lack of sufficient oversight on the part of any executive officer; and ii) a decision by the compensation committee that one or more performance metrics used for determining previously paid compensation was incorrectly calculated and, if calculated, correctly would have resulted in a lower payment to one or more executive officers. However, the Audit Committee to effect an accounting restatement of previously published financial statements caused by material non-compliance by the company with any financial reporting requirement under the federal securities laws due to fraud, misconduct, negligence, or lack of sufficient oversight on the part of any named executive officer, and |

| (ii) | a decision by the Compensation Committee that one or more performance metrics used for determining previously paid compensation was incorrectly calculated and, if calculated correctly, would have resulted in a lower payment to one or more executive officers. |

The requirement to repay the incentive compensation that is recoverable under this policy shall only exist if the boardBoard of Directors has actively taken steps to evaluate restating the financials or operating results, or recalculating other associated metrics prior to the end of the fifth year following the year in question. The company will not be bound by the three-year recoupment period or this five-year limitation in cases involving fraud or intentional misconduct. OnceAs applicable SEC regulations are adopted, we will reassess our clawback policy in light of the new rules and will implement appropriate changes to ensure that our policy is fully compliant with SEC regulations.

Stock Ownership Program. We have adopted a stock ownership program for our directors, and executive vice presidents and above, with our CEO required to own a fixed number of shares based on five times his base salary. A detailed description of each of these programs and the minimum share ownership requirements is included on page 20 and page 38 for directors and executives, respectively.

| 14 | Realty Income|2017 Proxy Statement |

Committee Charters. Our Board of Directors has adopted a charter for each of the Audit Committee, the Compensation Committee, the Nominating/Corporate Governance Committee and the Strategic Planning Committee. Each of our charters is reviewed annually. Our Board of Directors may, from time to time, establish certain other committees to facilitate our management. We have also adopted Corporate Governance Guidelines that promote the functioning of the Board of Directors and its committees and sets forth expectations as to how the Board of Directors should perform its functions. The guidelines include information about the composition of the Board of Directors, orientation and continuing education, director compensation, Board of Directors meetings, Board of Directors committees, management succession, evaluation and compensation of senior officers, expectations of directors and information regarding the annual performance evaluation of the Board of Directors.Corporate Governance

12

Table of Contents

Social Responsibility and Ethical Standards.Standards We are committed

An extension of our mission is our commitment to being socially responsible and conducting our business according to the highest ethical standards. Our employees enjoyare awarded compensation that is in line with those of our peers and competitors, including generous healthcare benefits for employees and their families;families, participation in a 401(k) plan with a matching contribution by Realty Income;Income, competitive vacation andpaid time-off benefits; paid maternity leavebenefits, and an infant-at-work program for new parents. We also have a longstanding commitment to equal employment opportunity and adhere to all Equal Employer Opportunity Policy guidelines. Our employees also have access to members of our Board of Directors to report anonymously, if desired, any suspicion of misconduct by any member of our senior management or executive team. We also have a long-standing commitment to equal employment opportunity and adhere to all Equal Employer Opportunity Policy guidelines.

We apply the principles of full and fair disclosure in all of our business dealings, and we encourage all of our directors, officers, and other employees to conduct our business in accordance with the highest standards of moral and ethical behavior, in each case, as outlined in our Corporate Code of Business Ethics. We are also committed to dealing fairly with all of our customers, suppliers, and competitors.

Realty Income and its employees have taken an active role in supporting communities through civic involvement with charitable organizations, and corporate donations. Focusing our impact on social responsibility, our non-profit partnerships have resulted in approximately 700 employee volunteer hours during 2016, principally through our partnership with San Diego Habitat for Humanity. Our employees have also provided educational services to at-risk youth, funding to local foodbanks, and toys for under-served children. Our dedication to being a responsible corporate citizen has a direct and positive impact in the communities in which we operate and contributes to the strength of our reputation and our financial performance.

Environmental Practices.Practices

Our focus on energy related mattersenvironmental conservationism is demonstrated by how we manage our day-to-day activities inat our corporate headquarters building. Inheadquarters. At our headquarters, building we promote energy conservationefficiency and encourage the following practices:

·Poweringpractices such as powering down office equipment at the end of the day;

·Setting faxday, implementing file-sharing technology and copier machinesautomatic “duplex mode” to “energy saver mode”;

·Encouraging employeeslimit paper use, adopting an electronic approval system, carpooling to reduce paper usage whenever possible, by storing documents electronically and using “duplex” copy mode;

·Employing an automated “lights out” system that is activated 24/7; and

·Programming HVAC to only operate during normal business operating hours.

In addition, our headquarters, building was constructed accordingand recycling paper waste. In 2016, we sent more than 29,500 pounds of paper to the State of California energy standards and we have installed solar panels on our roof to fulfill our energy requirements. All of the windows on our building are dual-paned to increase energy efficiency and reduce our carbon footprint.off-site partner for recycling.

With respect to other recycling and reuse practices, we encourage the use of recycled products and the recycling of materials duringused in our operations. Recycling bins are placed in all areas where materials are regularly disposed of and at the individual desks of our employees. Cell phones, wireless devices and office equipment isare recycled or donated whenever possible. We also continue to pursue a paperless environment since this reduces costs and saves trees. As a result, we encourage file-sharing networks and environments to produce and edit documents in order to reduce the dissemination of hard copy documents, and have implemented an electronic invoice approval system.

With respectIn addition, our headquarters building was retrofitted according to the State of California energy efficiency standards (specifically following California Green Building Standards Code and Title 24 of the California Code of Regulations), with features such as an automatic lighting control system with light-harvesting technology, a Building Management System that monitors and controls energy use, an energy-efficient PVC roof and heating and cooling system, LED lighting, and drought-tolerant landscaping with recycled materials.

The properties that we own, these propertiesin our portfolio are net-leasednet leased to our tenants who are responsible for maintaining the buildings and are in control of their own energy usage and environmental sustainability practices. We remain active in working with our tenants to promote environmental responsibility at the properties we own and to promote the importance of energy efficient facilities.

Our Asset Management team has engaged with a renewable energy development company to identify assets that would maximize energy efficiency initiatives throughout our property portfolio. These initiatives include solar energy arrays, battery storage, and charging stations. In addition, we continue to explore regional opportunities with our tenants in order to qualify for city and county energy programs.

More information on our corporatesocial responsibility effortsand environmental practices can be found on our company’s website at http://www.realtyincome.com/invest/investing-resources/corporate-responsibility.shtml.about-realty-income/corporate-responsibility/default.aspx.

| Realty Income|2017 Proxy Statement | 15 |

Board of Directors and Corporate Governance

Director Selection Process

Director Qualifications

Director qualifications are determined by what the Nominating/Corporate Governance Committee believes to be the essential competencies required to effectively serve on the Board of Directors. The Nominating/Corporate Governance Committee seeks to include on our Board of Directors a complementary mix of professionals with the following qualities, skills, and attributes:

| ● | Personal and professional integrity, ethics, values, and absence of conflicts of interest; |

| ● | Experience in corporate governance, for example as an officer or former officer of a public company; |

| ● | Experience in our industry and a general business understanding of major issues facing public companies; |

| ● | Experience as a member of the board of directors of another publicly-held company; |

| ● | Ability to fairly and equally represent all stockholders of the company and time to devote to being a director; |

| ● | Practical and mature business judgment, including the ability to make independent analytical inquiries and function effectively in an oversight role; |

| ● | Academic expertise in an area of our operations and achievement in one or more applicable fields; |

| ● | Background in financial capital markets and accounting matters; and |

| ● | Diversity in terms of background, expertise, perspective, age, gender, and ethnicity. |

Identifying and Evaluating Nominees for Directors

Our Corporate Governance Guidelines set forth the process by which our Nominating/Corporate Governance Committee identifies and evaluates nominees for our Board of Directors. The Nominating/Corporate Governance Committee first evaluates the current members of our Board of Directors to identify nominees for directors. Current members who are willing to continue service and who have qualifications and skills that are consistent with the Nominating/Corporate Governance Committee’s criteria for Board of Directors service are re-nominated.